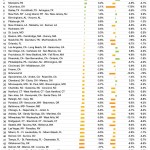

In the month of February, there were 14 sales in Georgetown with an average sale price of $1,342,107 for a total sales volume of $18,789,500.00.

In the month of February, there were 14 sales in Georgetown with an average sale price of $1,342,107 for a total sales volume of $18,789,500.00.

This is the link to the PDF list of properties that were sold in Georgetown in the month of February:

Sold Properties

All sales data provided by MRIS.